Kelly Phillips Erb is a Philadelphia-area Forbes senior writer who covers tax, law, and financial crimes.

As a tax attorney, Kelly brings a legal perspective to her tax coverage.

She’s covered many tax-related Supreme Court cases, including South Dakota v. Wayfair, which changed how we pay sales tax online, and U.S. v. Windsor, which focused on the Defense of Marriage Act. Most recently, she reported on U.S. v. Moore, and the Corporate Transparency Act.

Kelly jokes that, as a tax attorney and writer, she aims to help taxpayers get out of trouble and stay out of trouble.

She has received several awards, including being named to the Philadelphia Business Journal’s "40 under 40" and one of the Global Tax 50 by the International Tax Review for her "tireless and passionate tax reporting."

Follow Kelly for tax news and industry updates—and subscribe to Tax Breaks, our free tax newsletter.

Have a confidential tip? Connect with Kelly on Signal @taxgirl.1040.

Forbes reporters follow company ethical guidelines that ensure the highest quality.

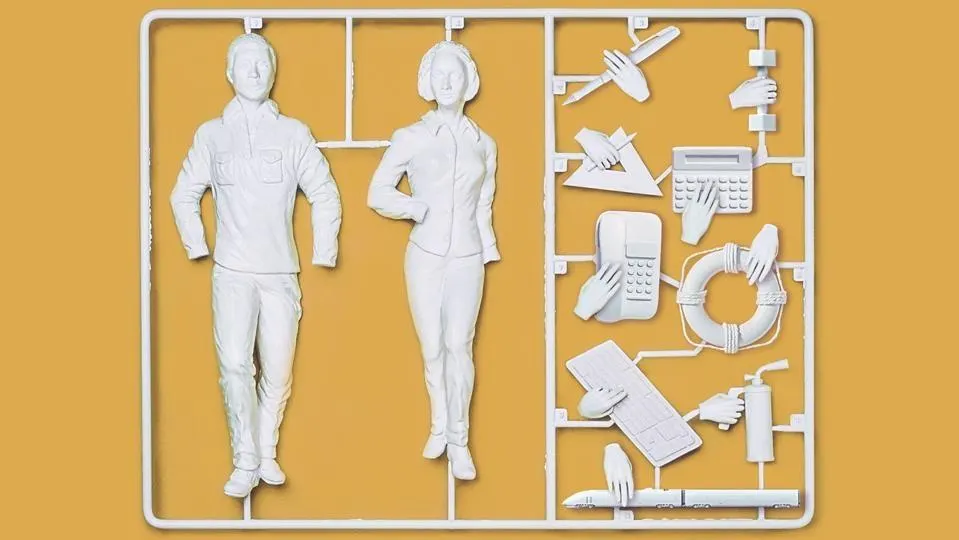

Forbes Small Business Toolkit–For The Trump Era

Forbes Staff

Forbes offers timely tips for those starting or running a small business today. While tariffs and tax and SBA changes create new challenges, some basics remain the same.

Tax Breaks: The Artificial Intelligence Is In Your Home, Office And The IRS Edition

Plus: A look at Form W-2 changes, private equity is eyeing your retirement accounts, protecting students from back-to-school scams, football news, tax trivia and more.

A First Look At Form W-2, Updated For Tips, Overtime, And Trump Account Provisions

The IRS has released drafts of some 2026 tax forms, including a draft of Form W-2. The changes are intended to address tax reporting updates, particularly for tipped and overtime workers.

Is Private Equity Right For Your 401(k)? A Look At Potential Risks And Rewards

President Trump has signed an executive order that could pave the way for the use of private equity (PE) and alternative assets in retirement savings accounts.

The Use Of AI Is Taking Off At The IRS And Tax Firms—What Could It Mean For You?

Danny Werfel, strategic advisory board member at alliant and former IRS Commissioner, says that technology, including AI is playing a significant role in tax—including at the IRS.

As Kids Go Back To School, Get Educated On Scams That Target Students

Today’s kids are more digitally active than ever, making them vulnerable to online scams. Here’s a look at some back-to-school scams—and how to avoid becoming a victim.

Treasury Looks To Public For Input On New Stablecoins Reporting Law

The government is seeking input from the public on the GENIUS Act with a focus on four areas: application program interfaces (APIs), artificial intelligence (AI), digital identity verification, and the use of blockchain monitoring.

Tax Breaks: The Communicating With The IRS Edition

Plus: Energy tax breaks are disappearing, reports of better IRS phone service may have been exaggerated, changing your address, filing taxes abroad, tax trivia and more.

Doctor Sentenced In Tax Evasion And Health Care Fraud Case That Cost Government $1.6 Million

An Illinois doctor has been sentenced to 34 months in prison for committing health care fraud, hiding assets, and lying to the IRS about his ability to pay approximately $1.6 million in taxes, penalties, and interest.

IRS Confirms Early Termination Dates, Issues Guidance On Energy Credits

The One Big Beautiful Bill Act eliminated several energy credits including the clean vehicle credit and the residential clean energy credit. Here’s what you need to know.

Watchdog Says IRS Could Do Better Reporting Telephone Service And Wait Times

A Treasury Inspector General for Tax Administration (TIGTA) report evaluated the IRS’s telephone access and taxpayer wait times. There's room for improvement.