I am an international private client tax attorney with nearly 20 years of experience helping entrepreneurs and investors build and preserve wealth iincluding creating legacies, across industries, and in Philanthropy. My goal is to make complex tax planning understandable and relatable through storytelling integrated with law and tax strategies. In addition to a law degree and LL.M. in Tax from Villanova, and an MBA, I studied Journalism at Rutgers with the desire to inform and educate.

Missing In AI Action: Tax Risk For Investors In Intellectual Property

As AI innovation continues to grow, policies are shifting to promote development domestically, but investors often miss optimally-timed tax planning

Moving From The US To Italy: The Many Flavors Of Tax

Italy's favorable flat tax and affordable lifestyle entices Americans, but its forced heirship regime, U.S. worldwide tax regime and succession laws present challenges.

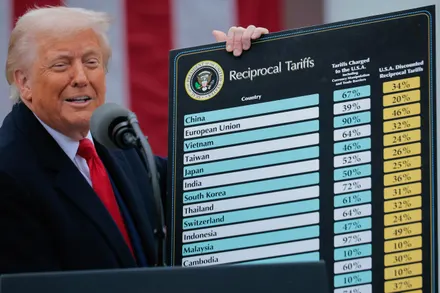

Restructuring For Pharma Founders Facing Tariffs

As Tariffs Increase, Small and Mid-Sized Pharmaceutical Industry Founders May Benefit from Restructuring to Protect Intellectual Property

Offshore Trusts Offer Liability Protection But May Create More Tax

Offshore trusts are not bulletproof and may have hidden tax issues

Reporting The Foreign Trust In Your Backyard

Foreign trust reporting obligations can apply to a domestic trust established even within the US and the recent regulations make compliance more difficult.

GENIUS Act Supporting Stablecoins Offer Opportunity During Instability

GENIUS Act passed by the Senate in June 2025 and headed to the House of Representatives provides a rare opportunity to engage in rapid global investments especially during times of instability

U.S. Estate Tax Follows Expatriates Under Section 2801

Expatriation has attracted IRS scrutiny and more reporting and compliance obligations. Estate and gift tax follow expatriates years after they leave.

Proposed Section 899 Of Big Beautiful Bill Challenges Global Investors

Proposed Section 899 of Big Beautiful Bill Tax Act May Expose Long-term Foreign Investors and US Asset Holders to Unexpected Taxes

Curating Freeports And Foreign Asset Protection With Evolving Tariffs

Tariff and tax law uncertainty challenge freeports that have been used for centuries by the wealthy to store and transfer luxury goods tax and tariff free.

Innovation Challenges To Business Families’ Wealth In A Global Economy

By 2021, over 80 percent of businesses had adapted to digitization but, as a Deloitte study reported, as of February 2025, nearly 75 percent of family offices are unde...