I am Executive Vice President and Chief Strategist for William O’Neil + Co., an independent advisory firm providing global buy and sell recommendations, independent research, and custom advisory to many of the world’s leading institutional investment managers. Previously I was Senior Portfolio Manager for O’Neil Global Advisors (OGA), an SEC registered Investment Advisor that specializes in fundamental, quantitative, and technical investment strategies for global equity markets. We use proprietary technical and fundamental factors that we have found to be statistically significant and predictive of future price movements to manage long-only and long/short portfolios for clients. I have managed numerous long-only and long-short hedge funds, mutual funds, and institutional accounts and overseen investment teams at Folger Hill Asset Management, Freedom Capital Management, Westfield Capital Management, and The Boston Company. I am a Chartered Financial Analyst and am regularly featured on Reuters TV, Bloomberg Radio, CNBC, and Fox Business.

Why Market Breadth Could Decide The Next Leg Higher

Randy Watts and Kenley Scott analyze market rally strength, stock breadth, and breakouts, highlighting risks of mega-cap concentration in today’s bull market.

Capital Spending As The Key Market Driver?

2025 U.S. capital spending trends: AI infrastructure growth, tax incentives, and the impact of mega-cap tech investments on economic performance.

Q2 Earnings Preview

The stock market has had a historic rally from its April 7 low. Since that time, the S&P 500 has rallied strongly to achieve new record highs. This up leg has climbed a wall of worry that has included a trade war, a conflict between Israel and Iran in the Middle East, the U.S. bombing Iran, as well as economic concerns and a Federal Reserve on pause. The next obstacle for the stock market rally to continue is Q2 earnings season, which commences next week with many of the large Financial stocks reporting.

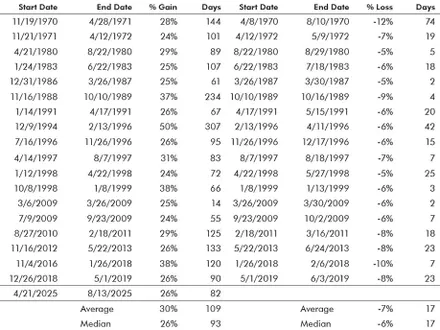

U.S. Market Seasonality

Through the bulk of the first half, the U.S. market has performed closely in line with its history in the first year of the presidential cycle.

USD Weakness

the U.S. Dollar Index has declined from a high in January from roughly 110 to 97 in April. Recently, it has risen slightly but remains near its 52-week lows.