- feature

- TAX PRACTICE MANAGEMENT

2025 tax software survey

AICPA members in tax practice assess how their return preparation software performed during tax season and offer insights into their procedures.

Related

From practitioner to influencer: Managing the risks of online content for tax professionals

Results of recent academic research may aid practitioner planning

Tax ethical challenges when representing taxpayers

Few if any tools in a tax practice are more crucial to its operation than the professional tax return preparation software that CPAs rely upon to get them through tax season. Recognizing that its performance and suitability are matters of interest and comparison among tax professionals, The Tax Adviser and Journal of Accountancy have for many years surveyed AICPA members in tax practice soon after tax busy season regarding their impressions.

The 2025 tax software survey was completed between June 2 and June 20 by 2,011 AICPA members who prepared 2024 tax returns for a fee. They recorded their views of the software’s strengths and weaknesses, generally on a scale of a low of 1 to a high of 5, their top likes and dislikes, their experiences with product support, and other parameters.

Products covered

Seven products have long dominated the field, and 2025 is no different. With the percentages of respondents using them, they were:

- UltraTax CS, 22.9%;

- Drake Tax, 16.3%;

- Lacerte, 15.8%;

- CCH Axcess Tax, 12.5%;

- ProSeries, 10.5%;

- CCH ProSystem fx, 8.3%; and

- ATX, 4.6%.

That order is unchanged from 2024, and the percentages are little changed. The biggest shift was a 0.6–percentage–point slip in users of CCH ProSystem from 8.9% in 2024 and a 0.5–point reduction in ProSeries users. Slight gains were registered by Drake Tax (+0.4 percentage point) and UltraTax CS (+0.3 percentage point). Respondents could also select GoSystem Tax RS, ProConnect Tax, TaxAct, TaxSlayer Pro, TaxWise, and TurboTax. Three of these accounted for less than 1% of respondents, and altogether, the six represented 8.1%. ProConnect Tax had 3.8%, TaxACT 1.6%, and GoSystem Tax RS 1.2%. In addition, 0.9% said they used some product other than the 13 listed.

Consequently, the tables and discussion that follow relate to the seven major products, which are produced by four companies: (1) ATX, CCH Axcess Tax, and CCH ProSystem fx are products of Wolters Kluwer; (2) Lacerte and ProSeries are by Intuit Inc.; (3) UltraTax CS is a product of Thomson Reuters; and (4) Drake Tax is from Drake Software.

Profile of respondents

The table “Favorites by Firm Size,” below, shows the distribution of each major product among six ranges of size of respondents’ firms, from sole practitioners to those with more than 500 preparers. These correlations provide some context for the market share of the products. Drake Tax and ProSeries clearly predominate among sole practitioners, while UltraTax CS can claim nearly one–third of respondents in the largest firms represented (and CCH Axcess Tax one–quarter). When one looks at these figures the other way, as each product’s percentages of the ranges of firm size (not shown), some of these differentials stand out even more starkly: More than half of ATX’s users are sole practitioners (and 45% of users of Drake Tax). And one can see that CCH Axcess Tax is not solely the province of large firms; nearly 20% of its users are in firms of between six and 20 preparers. Notable, too, is the adoption of Lacerte, CCH ProSystem fx, and UltraTax CS among a broad midrange of firms.

Ratings

Respondents were also able to rate their software’s performance and suitability according to its ease of use generally and proficiency in other selected tasks, as well as give an overall assessment on a scale of 1 to 5 (see the table “Overall Ratings,” below). Drake Tax led the overall rating at 4.4, although it trailed the average 3.3 rating for integration with accounting and other software with a score of 3.0. Another broad attribute, ease of use, saw CCH Axcess Tax at 3.8 dip below the 4.2 average. In ease of importing data, ATX users registered a slight disaffection at 3.1, against an average of 3.4. A point of frustration for many preparers are the often frequent updates during the preparation season, either because of software fixes and improvements or late–breaking tax law changes. Attitudes toward such updates were generally benign, however, with an average of 4.4 for how well the product handled them. Drake Tax and ATX led the pack here, with 4.7 and 4.6 ratings, respectively. They also garnered the most assent to whether they’d be suitable for a starting tax practice, as they have previously, this time at 94.8% and 90.2%, respectively.

Top likes and dislikes

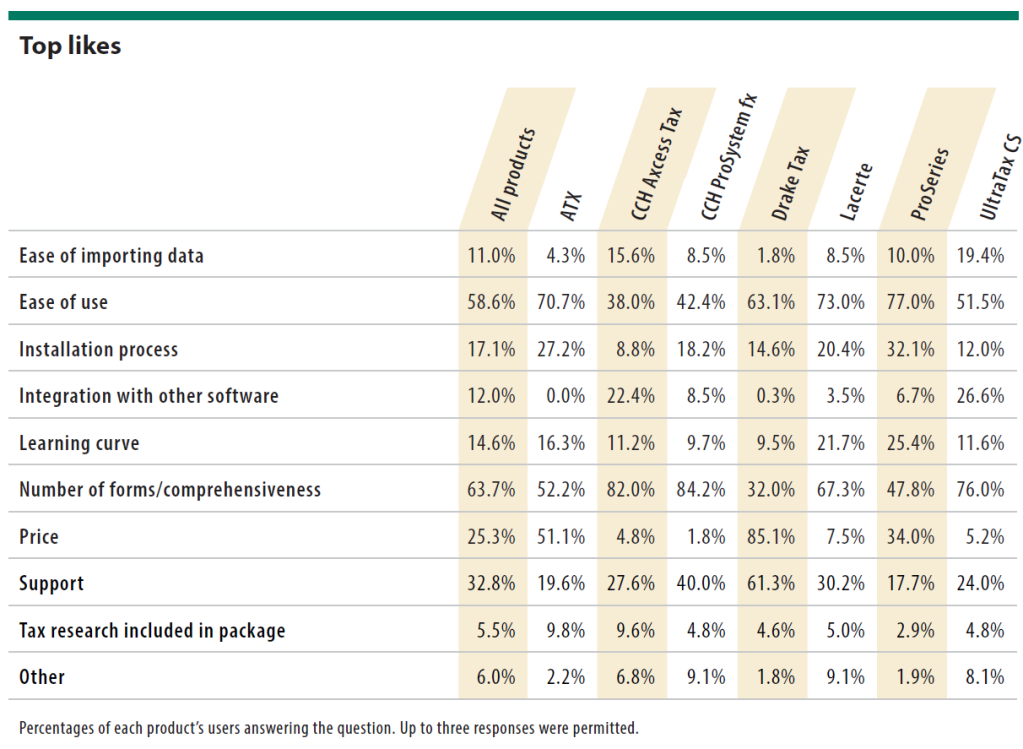

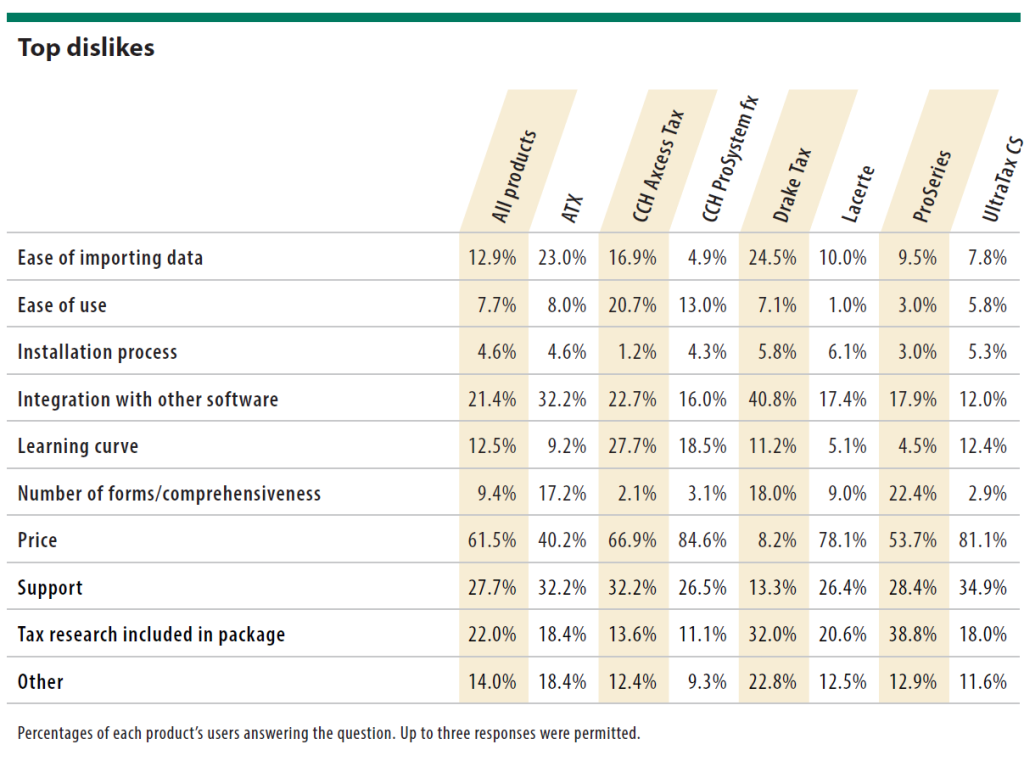

The survey again asked users to choose or name what they most liked or disliked about their software; the percentages shown in the tables “Top Likes,” and “Top Dislikes,” both below, are of the users of each product choosing that attribute or feature. Up to three answers were permitted. Among the things many users liked best were how many of the myriad IRS forms or their functions were available (“Number of forms/comprehensiveness”). Nearly 64% of users of all seven products chose this as a favorable point, most markedly those using CCH ProSystem fx (84.2%), CCH Axcess Tax (82%), and UltraTax CS (76%). Fewer than one–third of Drake Tax users picked this as a top virtue. In a related question not shown in the tables, respondents were asked whether their software contained all the forms they needed. Overall, 82.8% said yes, and four products surpassed that average, CCH ProSystem fx (91%), UltraTax CS (90.4%), Drake Tax (84.7%), and CCH Axcess Tax (83.7%).

Drake Tax users were relatively sanguine about the product’s support, with 61.3% picking it as something to like, against an average of 32.8%.

Among top dislikes, one stands out again this year: price. Most tax practitioners seem to feel they pay too much for their software. For all products, this was by far the biggest complaint, at an average of 61.5%. Rather, make that nearly all; only 8.2% of Drake Tax users disliked its price. And correspondingly, among top likes, 85.1% of Drake Tax users picked price, far more than any other product’s users.

Difficulties with state returns came up repeatedly in “dislike” write–in responses, despite the generally favorable marks for multistate business returns shown in the “Overall Ratings” table. Among write–in likes, some users mentioned their constancy and familiarity with the product, such as one CCH ProSystem fx user who said, “I’ve been using it for 25+ years.”

Training and support

Some write–in dislikes mentioned a dearth of available training in using the software, a complaint that might be reflected in the results to the question “Have you received training from your software provider?” Nearly 60% of all major products’ users answered “no,” which was highest for ATX (87%) and ProSeries (75.4%). Thus, it might be surprising that the percentage of users needing technical support was not higher than the 75.6% who said they did (see the table “Technical Support,” below).

Nor was tech support necessarily easily obtained or as helpful as could be desired; ratings for ease of getting it and its quality averaged 3.8 for both. Drake Tax led in both propositions, at 4.4 for ease of getting support and 4.1 for its quality. Most respondents who did obtain tech support did so by phone, a perennial finding. Alternative channels of email and live chat/instant messaging, however, continued a long–term slow rise, with email ticking up 0.6 percentage point and live chat/instant messaging by 1.4 points from 2024.

In another technology–related question, 71.5% of users of these products said they ran their software from their own hard drive or local network rather than on the vendor’s server. However, for users of CCH Axcess Tax, 81.7% said they used it on the vendor’s server, in keeping with this product’s cloud operation. Among write–in likes and dislikes, some respondents mentioned cloud access as a desirable or valued trait.

Tax planning software

In addition, the survey asked about tax planning software other than for return preparation, products that guide advising clients in such financial planning areas as retirement, estates, and charitable giving. Of the six products listed, respondents most often said they used eMoney, a product of eMoney Advisor LLC. However, no single product predominated; most often, respondents wrote in some other product.

Assessing the prospects

While tax return preparation software has come a long way, CPAs’ robust use of it can reveal drawbacks and highlight strengths. Hopefully, this survey’s results can help them assess that experience in the context of a community of users and either inform them regarding possible alternatives to the product they have been using or confirm that they’ve made the right choice.

Contributor

Paul Bonner is The Tax Adviser’s editor-in-chief. For more information about this article, contact thetaxadviser@aicpa.org.

MEMBER RESOURCES

Webcasts

Tax Practice Quarterly: Navigating Tax Tech Innovations in 2026

For more information or to make a purchase, visit aicpa-cima.com/cpe-learning or call 888-777-7077.