- tax clinic

- partners & partnerships

Potential recapture pitfall for profits-interest partners

Related

Economic substance doctrine and related-party partnership transactions

Making sense of nonrecourse deductions in partnership taxation

Complications in Sec. 743(b) substituted basis transactions

Editor: Christine M. Turgeon, CPA

Sec. 1245(a) provides a formulaic approach to determining the amount, if any, of ordinary income to be recognized on the disposition of depreciable and amortizable property. The determination is based on the lesser of two amounts: (1) the gain recognized on the disposal of the property or (2) the total historical depreciation or amortization deductions taken on the property. Regs. Sec. 1.1245–1(e) provides rules regarding how Sec. 1245 recapture of partnership depreciation and amortization is allocated among its partners. The regulation first compares each partner’s share of the gain on the property to each partner’s historically allocated amount of depreciation or amortization deductions from that property, limiting the initial recapture amount to the amount of gain allocated to the partner. In other words, a partner’s share of the gain limits that partner’s share of the partnership Sec. 1245 recapture. This limitation can lead to unexpected results for profits–interest partners.

Unexpected results

Profits–interest partners frequently are allocated a share of the gain recognized in connection with a liquidity event. This allocation can lead to unexpected results related to Sec. 1245 recapture. Often, these partners did not share in historical depreciation or amortization deductions because they had not met their participation thresholds at the time. However, when the liquidity realization event occurs, these thresholds may be satisfied. As a result, under the gain limitation provisions of Regs. Sec. 1.1245–1(e)(2)(i), these partners could be allocated Sec. 1245 ordinary income even though they were not previously allocated any depreciation or amortization deductions.

Although a potential trap for the unwary, this impact is not an unintended result of the regulations. As highlighted in the preamble to Prop. Regs. Sec. 1.1245–1, REG–209762–95, 61 Fed. Reg. 65371 (Dec. 12, 1996), a partner may be allocated more Sec. 1245 recapture than the partner’s share of historical depreciation. As noted in the preamble, the regulations are meant “to insure, to the extent possible, that a partner recognizes recapture on the disposition of property in an amount equal to the depreciation or amortization deductions previously taken by the partner on the property.” However, certain fact patterns, such as those involving profits–interest partners, may result in the allocation of excess recapture to other partners.

Nonetheless, the sentiment is echoed in T.D. 8730, 62 Fed. Reg. 44214 (Aug. 20, 1997), for the final regulations, which indicates that “the IRS and Treasury continue to believe that matching depreciation recapture allocations to depreciation allocations most appropriately carries out the policies underlying section 1245.” But the final regulations also state that “no partner’s share of depreciation recapture from the property can exceed that partner’s share of the total gain arising from the disposition of the property.”

Example: Partner A and Partner B form Partnership AB, with each contributing $100 and each receiving 100 Class Y units. Partner C is granted 100 Class Z units, which are profits–interest units under Rev. Procs. 93–27 and 2001–43. The partnership agreement provides that net profits and losses will be allocated such that after the return of capital, Partners A, B, and C each receive an equal amount of proceeds on liquidation.

In year 1, the partnership acquires machinery for $200 and depreciates it over a five–year period. In each of those years, the partnership recognizes net losses equal to the depreciation deductions. Partners A and B are each allocated $100 of depreciation deductions over that period, and since there are no profits, Partner C receives no allocations of profit or loss. In year 6, the partnership has $200 of operating income that is allocated to Partners A and B, which restores their capital accounts back to $100 each, and at that point Partner C’s participation threshold has been met.

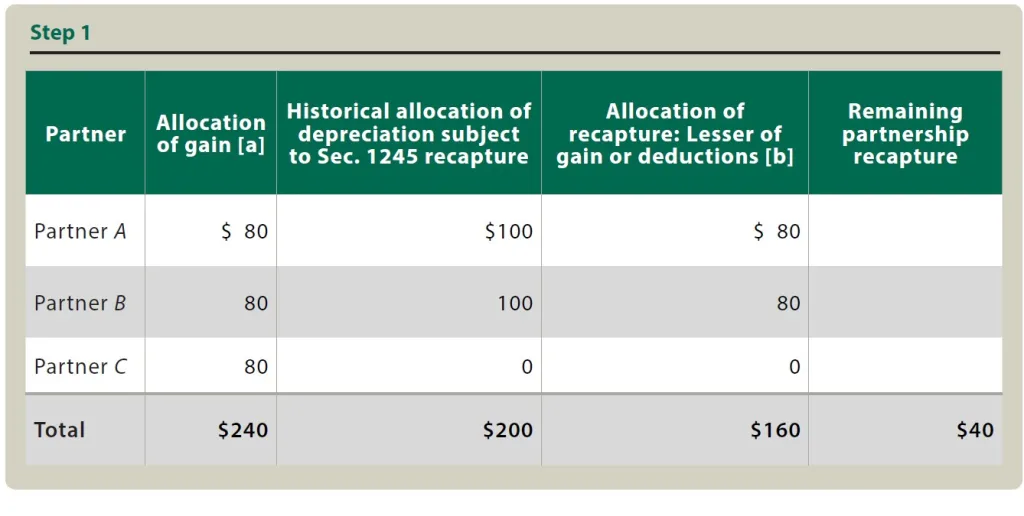

In year 7, the partnership sells the machinery for $240 and liquidates. The asset has zero tax basis, so the partnership recognizes $240 of gain, of which $200 is ordinary under Sec. 1245 and $40 is Sec. 1231 gain. Pursuant to the partnership agreement, Partners A, B, and C receive $180, $180, and $80, respectively, in cash on liquidation and are each allocated $80 of income on their final Schedules K–1, Partner’s Share of Income, Deductions, Credits, etc. The character of the income for each partner is determined under Regs. Sec. 1.1245–1(e)(2)(i).

To determine each partner’s share of the recapture income, Regs. Sec. 1.1245–1(e)(2)(i) first requires examining each partner’s individual situation to determine the lesser of their share of the gain from the sale of the asset or their historical depreciation deductions from the asset. For Partners A and B, the lesser of the two is the $80 of gain (compared to $100 of depreciation deductions). For Partner C, the lesser amount is its allocable share of historical depreciation deductions, or zero, as compared to its $80 of gain.

Following this first step, only $160 of Sec. 1245 recapture has been allocated, $80 each to Partners A and B, and $0 to Partner C. This leaves $40 of recapture to allocate to the partners. Pursuant to Regs. Sec. 1.1245–1(e)(2)(i), the partnership’s remaining Sec. 1245 recapture must be allocated among the partners that have excess gain based on their relative share of the total gain that exceeds their share of depreciation from the property. The remaining $40 of Sec. 1245 gain cannot be allocated to Partners A and B because their gains ($80 each) do not exceed the depreciation deductions they received from the property ($100 each). As a result, the remaining $40 of recapture must be allocated to Partner C, the only partner whose share of the gain ($80) exceeds their share of the deprecation ($0), resulting in $40 of ordinary income and $40 of Sec. 1231 gain to Partner C. The tables “Step 1” and “Step 2 and Summary” illustrate this example. See also Regs. Sec. 1.1245–1(e)(2)(iii) for similar examples.

Economic-effect rule

As illustrated in the example, even partners that do not share in depreciation and amortization deductions can be allocated Sec. 1245 recapture due to the gain limitation provision in Regs. Sec. 1.1245–1(e)(2)(i). Taxpayers may seek to mitigate this adverse consequence by including special allocation language in the partnership’s operating agreement specifying that any Sec. 1245 recapture should be allocated to the partners who were allocated the deductions that gave rise to the Sec. 1245 recapture.

However, special allocations cannot override the general economic–effect rules of Sec. 704(b). For a special allocation to be respected, it must have “economic effect,” meaning it should affect how partners share in the partnership’s distributions. Furthermore, because Sec. 1245 is a recharacterization provision and not a stand–alone item of the partnership’s profits and losses, presumably, any special allocation of gain–limited recapture would actually involve a reallocation of the gain under Sec. 704(b) that would then “drag” the desired recapture amount to the appropriate partner.

Continuing from the initial example, consider this alternative: If the partnership agreement instead provided that gain is first allocated to the partners who received the depreciation deductions, and Partner C is then filled up to equalize, Partners A and B would each receive $100 of gain with a corresponding amount of recapture, and Partner C would receive $40 of gain with no recapture. But critically, Partners A and B each also receive $200 of liquidating cash proceeds (compared to $180 in the initial example), and Partner C receives only $40 (compared to $80 in the initial example).

Both the initial and alternative examples could be viewed as meeting the economic–effect requirements such that the allocations would be respected, but the economic result is clearly different. The proposed regulations’ preamble highlights this issue. Taxpayers seeking to resolve the potential problems resulting from the gain–limitation rule should be careful to keep the economic–effect requirement in mind when considering special allocations.

Observations

Despite the intent of Sec. 1245 to tie depreciation recapture to the historically taken deductions, issues may arise when partners are gain–limited, resulting in the allocation of Sec. 1245 recapture to another partner. Mitigation techniques such as special allocations of the Sec. 1245 recapture in the operating agreement do not provide a reprieve unless the allocation has economic effect. Ultimately, the allocation must adhere to the formulaic approach laid out in Regs. Sec. 1.1245–1(e). Although there is no perfect solution, being aware of the potential pitfalls ahead of a transaction will allow profits–interest partners to prepare for the tax consequences in advance rather than face unexpected tax consequences later.

Editor

Christine M. Turgeon, CPA, is a partner with PwC US Tax LLP, Washington National Tax Services, in New York City.

For additional information about these items, contact Turgeon at christine.turgeon@pwc.com.

Contributors are members of or associated with PwC US Tax LLP.